Why China and India's Drug Manufacturing Matters to You

When you pop a pill, you might not realize it was made in a factory thousands of miles away. But for drugs made in China and India, the safety risks aren't the same. Over 40% of medicines used in the U.S. come from these two countries, and understanding the pharmaceutical manufacturing risks between them is critical for drug safety. The FDA plays a huge role in determining which factories get approved and which face shutdowns.

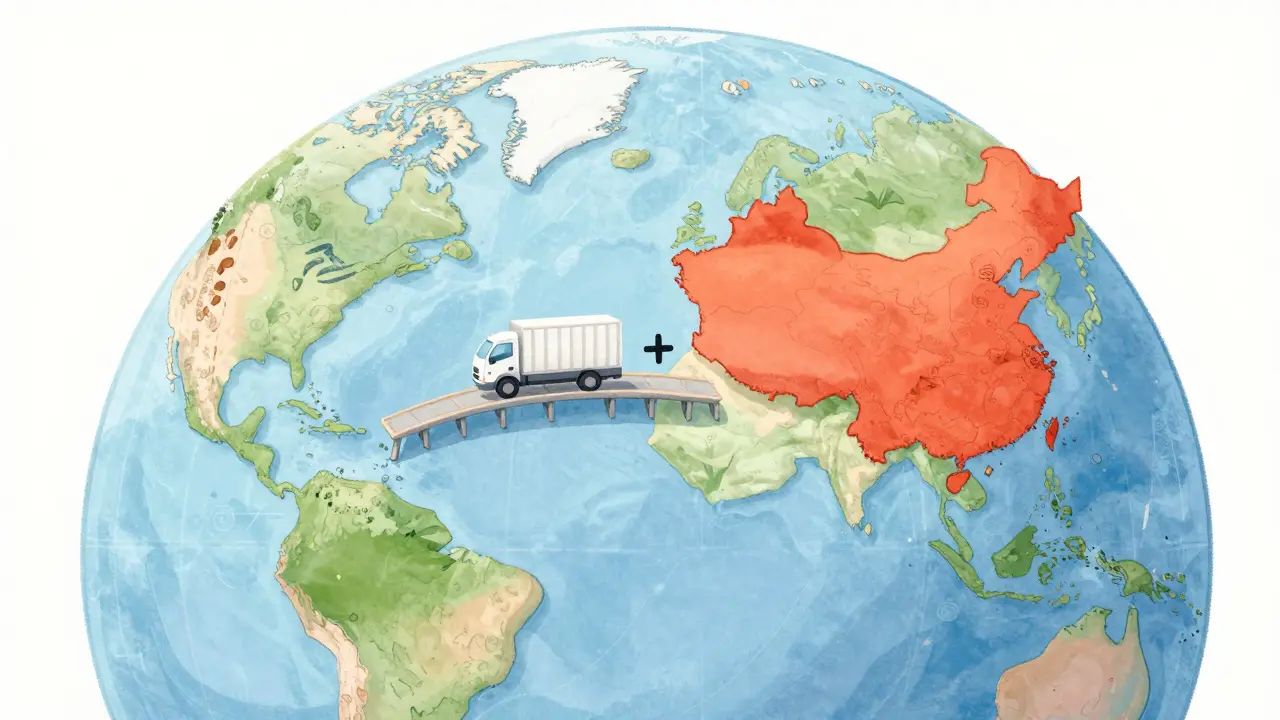

China and India's Role in Global Pharma Manufacturing

China controls about 80% of the global supply for active pharmaceutical ingredients (APIs), the key components in most medicines. Meanwhile, India has over 100 FDA-approved manufacturing plants, compared to China's 28. This means India's facilities are more likely to meet U.S. safety standards. But here's the catch: India gets 72% of its own APIs from China. So when China's supply chains face issues, India's drug production gets hit too.

The FDA inspects both countries' factories regularly. In 2023, 37% of Chinese facilities faced import alerts due to quality issues, while only 18% of Indian facilities did. This gap exists because India's regulatory system has focused on compliance for decades. Companies there use digital tools to catch errors before products leave the factory. China's factories produce more volume but struggle with consistency.

How FDA Monitors Manufacturing in China vs India

| Region | Import Alerts | Form 483 Observations |

|---|---|---|

| China | 37% | Higher |

| India | 18% | 30% lower than China |

The Form 483 is a critical document the FDA issues when inspectors find problems. Chinese facilities receive more of these warnings. For example, in 2023, Indian factories had 30% fewer Form 483 observations than Chinese ones. This shows India's better track record for following safety rules.

But China's situation is changing. Rising labor costs and geopolitical tensions mean some companies are moving production out of China. The China+1 strategy - where companies diversify suppliers - has made India a top choice for U.S. drugmakers. Why? Because India has a solid compliance history and English-speaking workforce that aligns with Western regulatory expectations.

Why India Leads in Regulatory Compliance

India's Schedule M regulations were updated in 2023 to boost quality standards. These changes help Indian factories meet WHO-GMP and FDA requirements. Companies like Alembic Pharmaceuticals now use digital monitoring tools across all plants to eliminate errors. This approach has helped India become the world's third-largest pharmaceutical producer by volume.

Over 50% of Asia-Pacific contract research organizations (CROs) are in India. These groups help test drugs for safety and effectiveness before they hit the market. This infrastructure makes India better positioned for complex drug manufacturing like biologics and biosimilars. The Bain & Company 2024 report shows India's biosimilars market is projected to grow at 22% annually through 2025.

China's Manufacturing Challenges Despite Scale

China's strength is scale. It produces more drugs overall than any other country. But quality consistency remains a problem. Smaller Chinese suppliers often cut corners to keep costs low. This leads to more FDA inspections and warnings. The Medstown 2023 analysis noted that "rising labor costs and a narrowing price differential are challenging China pharma."

Geopolitical tensions also make China riskier. In 2023, the FDA increased monitoring of Chinese facilities due to trade disputes. Import alerts for Chinese pharmaceutical companies hit 37% - more than double India's rate. This has pushed many U.S. drugmakers to seek alternatives. The China+1 strategy specifically targets India as a safer option.

What Companies Should Consider When Choosing Suppliers

For drugmakers, the choice between China and India isn't simple. China offers lower costs for high-volume API production. But if you need strict regulatory compliance - like for drugs sold in the U.S. or Europe - India is usually the better choice. The pharmaceutical supply chain must balance cost and safety. Many companies now use a mix of both countries to reduce risk.

Here's what to watch for:

- API dependency: India relies on China for 72% of its raw materials. If China restricts exports, India's drug supply could drop.

- Regulatory alignment: India's updated Schedule M rules make it easier to meet U.S. standards. China's regulations are improving but still lag.

- Supply chain resilience: The China+1 strategy helps companies avoid single points of failure. Diversifying suppliers between India and other countries reduces risk.

Companies that ignore these factors risk drug shortages or recalls. For example, a major U.S. pharmaceutical executive told Bain & Company in 2024: "The 72% import dependency on China for bulk drugs creates a single point of failure in our supply chain that we're urgently trying to address."

Future Trends in Pharma Manufacturing

India's "Make in India" initiative has allocated nearly $3 billion for pharmaceutical and medical device production. This has attracted $4 billion in investments as of April 2024. The goal is to reduce India's reliance on Chinese APIs and build more domestic capacity for high-value drugs like biologics.

Meanwhile, China is shifting toward innovation. It's investing in biopharmaceuticals, with a projected 19.3% annual growth rate from 2015-2024. But this doesn't yet offset its quality control issues. The Bain & Company 2024 roadmap projects India could reach $350 billion in pharmaceutical exports by 2047 - if it solves its API dependency problem.

Frequently Asked Questions

Why does the FDA monitor Chinese facilities more closely?

The FDA has increased monitoring of Chinese facilities due to historical compliance issues and geopolitical tensions. In 2023, 37% of Chinese pharmaceutical facilities faced import alerts compared to 18% of Indian facilities, reflecting stricter scrutiny on Chinese operations.

Is India really safer than China for drug manufacturing?

For U.S. and European markets, yes. India has over 100 FDA-approved plants versus China's 28. Indian factories also have 30% fewer FDA inspection issues. However, India depends heavily on China for raw materials, which creates its own risks. The safest approach is to diversify suppliers between both countries.

What is the China+1 strategy?

The China+1 strategy means companies source from China but also have a backup supplier in another country - usually India. This reduces risk from supply chain disruptions. For pharmaceuticals, India is the top choice because of its regulatory compliance and English-speaking workforce. Major drugmakers like Pfizer and Novartis now use this approach.

How does API dependency affect drug safety?

Active Pharmaceutical Ingredients (APIs) are the key components in drugs. If a country relies too much on imports for APIs, any disruption - like trade restrictions or factory shutdowns - can cause drug shortages. India gets 72% of its APIs from China, making its supply chain vulnerable. This is why many companies are now investing in domestic API production.

What should patients know about where their drugs are made?

Most prescription drugs in the U.S. come from China or India. The FDA ensures all imported drugs meet safety standards, but the inspection process differs. Drugs from India have a stronger compliance track record. Patients can check the drug's labeling for manufacturer information, but it's often not detailed. The best way to stay informed is to ask your pharmacist about the drug's origin and safety certifications.

13 Comments

Albert Lua

China and India both supply most of the US drug market, but their challenges differ. China's API production is massive but inconsistent quality, while India has better FDA compliance but depends on China for raw materials. It's a tangled web.

Dina Santorelli

China is poisoning us. End of story.

Andre Shaw

Actually, the FDA stats are skewed. China's factories are improving fast. India's 100 approved plants? That's just a myth. The real numbers are way lower. This article is full of lies.

Lisa Scott

FDA is controlled by Big Pharma. They're covering up the truth. China and India are both dangerous.

Cullen Bausman

China is a national security threat. We must stop importing drugs from there immediately. Safety first.

Katharine Meiler

The data shows India's compliance is better, but API dependency is a real issue.

We need to diversify suppliers across multiple countries to mitigate risk.

Relying on any single source is foolish.

Look at the 72% dependency on Chinese APIs for India-that's a massive vulnerability.

If China restricts exports, India's entire drug production could collapse.

We should also invest in domestic API manufacturing in the US.

Europe's regulatory framework is another model we could learn from.

The FDA's current inspection protocols are outdated.

They need to adopt more real-time monitoring systems.

Blockchain technology could help track supply chains transparently.

Companies like Pfizer are already moving some production to Ireland and Singapore.

This isn't just about safety-it's about national security.

We need a comprehensive strategy, not just patchwork solutions.

The cost of inaction could be lives lost during shortages.

It's time to take this seriously.

Danielle Vila

China's factories are using banned chemicals that cause cancer. The FDA is ignoring this because of trade deals. We're all being poisoned.

Thorben Westerhuys

Oh my God, this is so scary! I can't believe they're doing this to us!! We need to act now!!!

Laissa Peixoto

It's interesting how geopolitical factors affect drug safety. We need to think beyond just supply chains. The real issue is systemic underfunding of regulatory agencies worldwide.

Lana Younis

this is a cool article. India and China both have their strengths. Maybe we should look at more than just FDA stats. Like, what about environmental impact? Just saying.

Samantha Beye

Good point about environmental impact. It's often overlooked but crucial for long-term sustainability.

Joyce cuypers

I think this is really important info. The FDA does need to check these factiries more. But maybe we should also support local production? Just a thought.

Andre Shaw

Actually, the China+1 strategy is flawed. India's regulatory system is still not up to par. They have more FDA-approved plants but the quality is inconsistent. We need to look at other countries like Vietnam or Mexico.