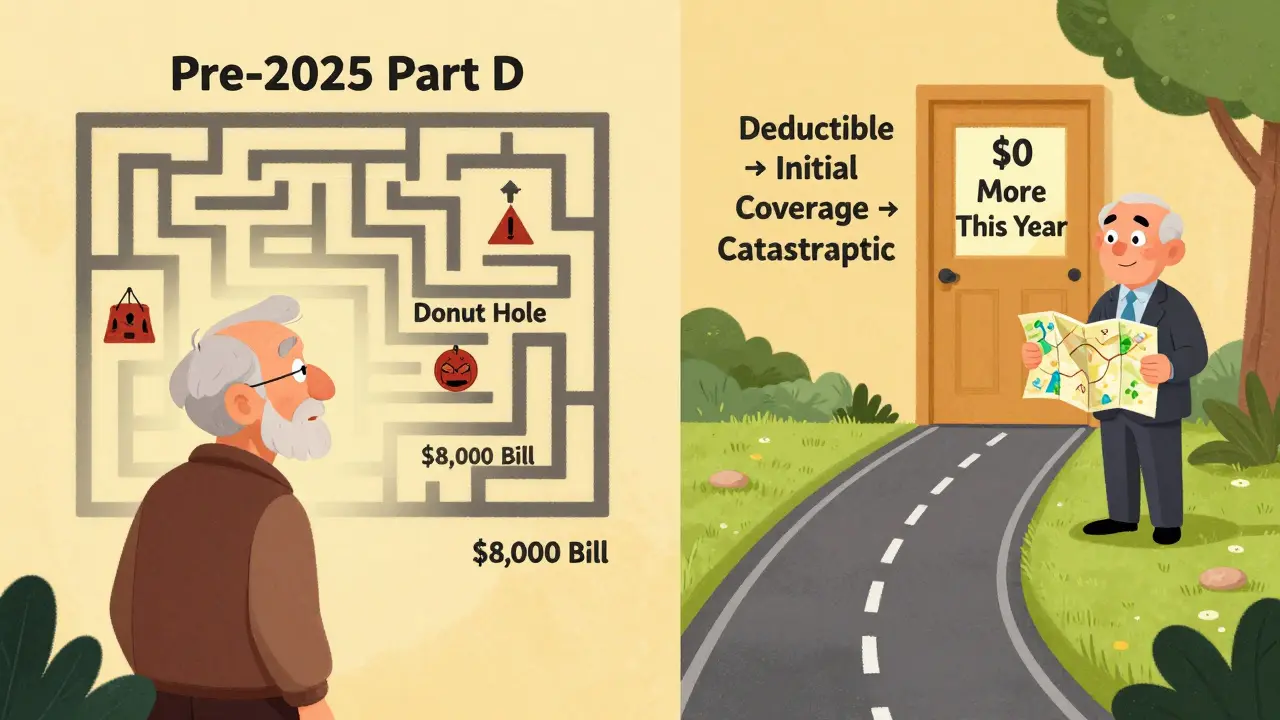

For millions of Medicare beneficiaries, paying for prescription drugs used to feel like a maze with hidden traps. One year you were fine, the next you hit the "donut hole" and suddenly your insulin cost hundreds of dollars a month. That’s all changed in 2025. The biggest overhaul of Medicare Part D since it started in 2006 is now in effect - and it’s designed to stop you from being blindsided by drug bills.

What Medicare Part D Actually Covers

Medicare Part D is prescription drug coverage you get through private insurance companies approved by Medicare. It’s not automatic - you have to sign up for it separately, even if you’re already on Medicare Part A and Part B. It covers both brand-name and generic drugs that are on your plan’s list, called a formulary. Every plan has its own list, so what’s covered in one plan might not be in another.

The 2025 redesign doesn’t change what drugs are covered - it changes how much you pay. The goal? Make costs predictable. No more guessing where you stand in a confusing four-phase system. Now, there are just three phases: deductible, initial coverage, and catastrophic coverage.

The New 2025 Coverage Phases - Simple and Clear

Here’s how it works now:

- Deductible phase: You pay 100% of your drug costs until you hit $590. This is the most you’ll pay out of pocket before your plan starts helping. Some plans have no deductible at all - check your plan details.

- Initial coverage phase: After you hit the deductible, you pay 25% of the cost for each covered drug. Your plan pays 65%, and drug manufacturers give a 10% discount on brand-name drugs. This phase continues until your total out-of-pocket spending (including what you paid during the deductible) reaches $2,000.

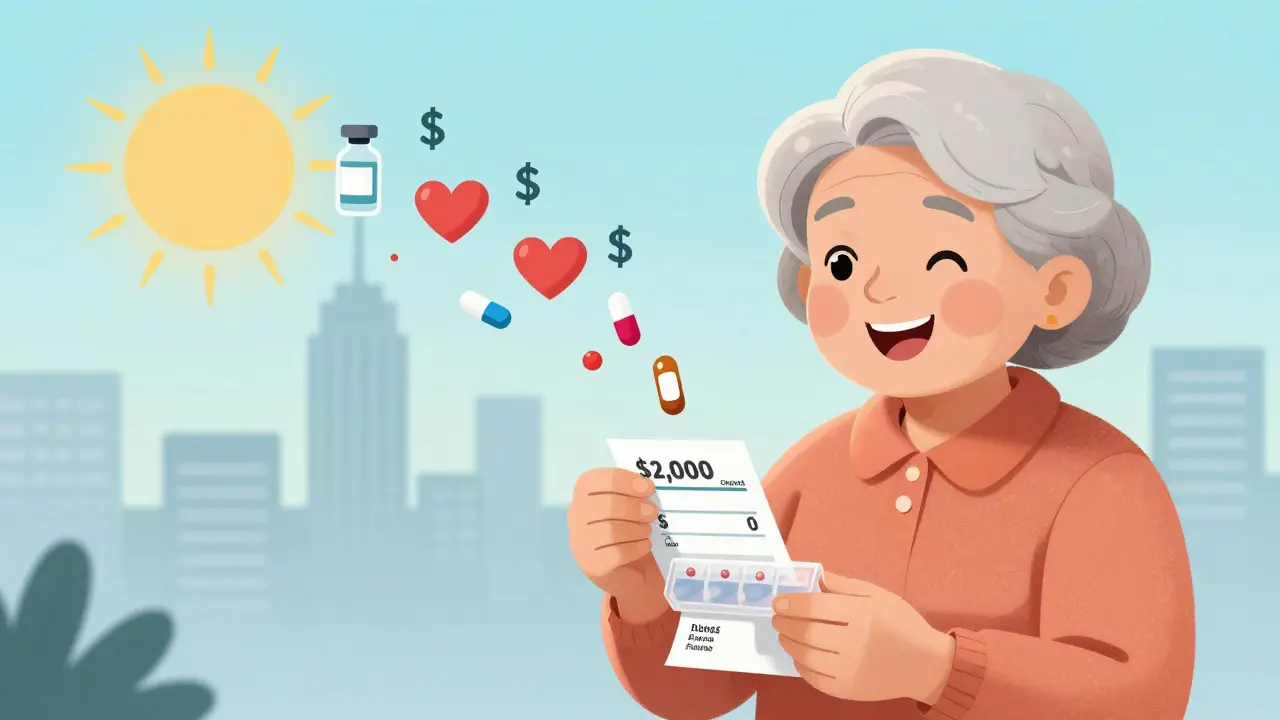

- Catastrophic coverage phase: Once you hit $2,000, you pay nothing for covered drugs for the rest of the year. Not 5%. Not 10%. Nothing. The plan pays 60%, manufacturers pay 20%, and Medicare pays 20%.

This $2,000 cap is the biggest change. Before 2025, beneficiaries could pay up to $8,000 out of pocket before reaching catastrophic coverage. Now, if you take expensive medications - like those for cancer, multiple sclerosis, or rheumatoid arthritis - you’re protected. You won’t pay more than $2,000 total in 2025 for your prescriptions.

Insulin and Other Fixed-Cost Drugs

You still pay no more than $35 for a month’s supply of insulin, no matter which plan you’re on. This rule hasn’t changed since 2023. Some plans also cap copays for other common drugs like certain diabetes medications or heart pills. Always check your plan’s formulary to see if your drugs are on a lower-cost tier.

Monthly Premiums - They Still Exist

The $2,000 cap is for what you pay for drugs, not your monthly plan premium. You still pay that every month, whether you use your drugs or not. In 2025, the average monthly premium for a stand-alone Part D plan is $45. For Medicare Advantage plans that include drug coverage, it’s $7. That’s a big difference.

Why the gap? Medicare Advantage plans bundle medical and drug coverage together. They often have lower premiums because they negotiate with providers and manage care more tightly. But they also limit which doctors and pharmacies you can use. Stand-alone plans give you more freedom but cost more upfront.

What About Low-Income Beneficiaries?

If your income is limited, you might qualify for Extra Help - a federal program that cuts your premiums, deductibles, and copays. In 2025, 90 stand-alone Part D plans will have $0 premiums for people getting Extra Help. These are called "Benchmark Plans." You still have to pick one, but you won’t pay anything extra for drug coverage.

Choosing the Right Plan in 2025

Even with the new cap, not all plans are equal. Two plans might both have a $2,000 out-of-pocket limit, but one might charge $100 for your blood pressure pill while the other charges $5. Here’s how to pick:

- Make a list of all your medications. Include the name, dose, and how often you take them.

- Use the Medicare Plan Finder tool. Go to medicare.gov/plan-compare and enter your drugs. It shows you total yearly costs - premiums, deductibles, and copays - based on your exact meds.

- Check the formulary. Is your drug covered? Is it on Tier 1 (cheapest) or Tier 5 (most expensive)?

- Look at the pharmacy network. Does your local pharmacy accept the plan? If you use a mail-order service, is it included?

- Compare total cost, not just premium. A $0 premium plan might charge high copays. A $50 premium plan might cover your drugs almost fully. Run the numbers.

Most people have access to 48 Part D plans in 2025. That’s fewer than last year - stand-alone plans have dropped by 7. But Medicare Advantage plans with drug coverage are growing fast. If you’re already in a Medicare Advantage plan, your drug coverage is included. You still need to check your formulary every year.

What You Still Need to Watch Out For

The $2,000 cap is great - but it doesn’t fix everything.

- Formularies change. Your plan might drop your drug next year. Always review your plan during Open Enrollment (October 15-December 7).

- Non-preferred drugs cost more. If your doctor prescribes a brand-name drug that’s not on your plan’s preferred list, you’ll pay more. Ask if there’s a generic or preferred alternative.

- High list prices remain. The redesign caps what you pay, but drugmakers can still set high prices. The government doesn’t control those prices - just your share.

- You still get charged a late enrollment penalty. If you didn’t sign up for Part D when you first became eligible and you didn’t have other creditable drug coverage, you’ll pay a penalty for as long as you have Part D. It’s 1% of the national base premium ($35.37 in 2024) for each month you delayed. That adds up to $4.24 extra per month, every year.

When to Enroll - Don’t Wait

You can sign up for Part D during your Initial Enrollment Period - the 7 months around your 65th birthday. If you miss it, you can enroll during the Annual Enrollment Period (October 15-December 7). Coverage starts January 1.

Even if you don’t take any drugs now, consider a low-premium plan. That way, if you need medication later, you won’t be hit with a penalty. The lowest-cost plans often have $0 premiums and modest copays. You’re not locked in - you can switch later.

Help Is Available

You don’t have to figure this out alone. Free help is right there:

- Call 1-800-MEDICARE (1-800-633-4227). They handled 78 million calls in 2023.

- Find your local State Health Insurance Assistance Program (SHIP). Trained counselors help you compare plans and understand your options. They helped 5.2 million people in 2023.

- Visit medicare.gov. The website has tools, videos, and downloadable guides.

One beneficiary told Medicare Interactive, "I no longer have to calculate where I am in the donut hole each month." That’s the point. The system is simpler. You know your max cost. You know when you’re covered. You can plan.

What’s Coming Next?

The $2,000 cap will rise to $2,100 in 2026 and adjust yearly for inflation. More changes are possible - especially around how new, expensive drugs are priced. But for now, the focus is on protecting beneficiaries from financial shock.

Experts predict the redesign will cut average out-of-pocket spending by 40% in 2025. The number of people hitting catastrophic drug costs will drop from 15% to under 2%.

This isn’t just a policy tweak. It’s a safety net. For people on fixed incomes, it means choosing between medicine and groceries - no longer a daily calculation.

Do I have to enroll in Medicare Part D if I don’t take any medications?

No, you don’t have to enroll if you don’t take prescription drugs. But if you wait and later decide to join, you’ll likely pay a late enrollment penalty for as long as you have Part D. That penalty is 1% of the national base premium ($35.37 in 2024) for each month you delay. Even a low-premium plan can protect you from that cost. If you’re healthy now, you might need drugs later.

Is the $2,000 out-of-pocket cap per year or lifetime?

It’s per calendar year. Every January 1, your out-of-pocket spending resets to zero. If you spend $2,000 on drugs in 2025, you pay nothing for the rest of the year. In 2026, you start over. The cap doesn’t carry over or accumulate. It’s designed to protect you from high costs each year, not to limit your total spending over your lifetime.

Does the $2,000 cap include my monthly premium?

No. The $2,000 cap only counts what you pay for your drugs - copays, coinsurance, and deductibles. Your monthly premium is separate and paid regardless of how much you use your drugs. You might pay $50 a month in premiums and $2,000 for drugs - that’s $2,050 total. But only the $2,000 counts toward the cap.

What if my drug isn’t on my plan’s formulary?

If your drug isn’t covered, you’ll pay the full price out of pocket - and it won’t count toward your $2,000 cap. You can ask your plan for an exception - your doctor can submit a request if there’s a medical reason your drug is necessary. Or you can switch plans during Open Enrollment to one that covers your medication. Always check your formulary before choosing a plan.

Can I change my Part D plan after I enroll?

Yes - but only during specific times. The main window is the Annual Enrollment Period from October 15 to December 7 each year. Your new plan starts January 1. You can also switch during the Medicare Advantage Open Enrollment Period (January 1-March 31) if you’re in a Medicare Advantage plan with drug coverage. Outside those times, you can only change under special circumstances - like moving out of your plan’s service area or qualifying for Extra Help.

How do I know if I’m getting Extra Help?

If you get Extra Help, you’ll get a letter from Social Security. You can also check your status by calling 1-800-MEDICARE or visiting ssa.gov. Extra Help reduces or eliminates your Part D premium, deductible, and copays. In 2025, 90 stand-alone Part D plans offer $0 premiums to Extra Help recipients. You don’t need to apply separately - if you qualify, it’s automatic.

Are all generic drugs cheaper than brand-name drugs under Part D?

Generally, yes. Generic drugs are usually on the lowest tier and cost less. But some brand-name drugs have lower copays than others - especially if your plan has a preferred brand tier. Always compare the exact cost of your specific drug on your plan’s formulary. Sometimes, a brand-name drug might be cheaper than a non-preferred generic. Don’t assume - check the numbers.

If you’re on Medicare and take prescriptions, the 2025 Part D changes are the most important update you’ll see this year. The $2,000 cap doesn’t fix everything - but it stops the worst-case scenarios. You no longer have to fear the next drug bill. You know your limit. You can plan. And that’s worth more than any premium discount.

12 Comments

Aurelie L.

This $2,000 cap is a godsend. I’ve been rationing my insulin for years. Now I can breathe.

shivam utkresth

Finally, someone in D.C. got it right. In India, we laugh at how Americans fight over $35 insulin - here, even generics cost more than a meal. But this? This is real policy. No more guessing. No more panic. Just clarity. I’ve seen elders skip doses because they didn’t know if they hit the donut hole. Now they can sleep. The formulary chaos? Still a mess, but at least the ceiling’s fixed. Pharma lobbyists are screaming, and honestly? Good. Let them scream. This isn’t charity - it’s justice.

Geoff Miskinis

Let’s not romanticize this. The $2,000 cap is a bandage on a hemorrhage. Drug manufacturers still set astronomical list prices - they just get reimbursed by Medicare and the feds. The real issue? The lack of price negotiation. This reform shifts burden, not cost. You’re still paying - just via taxes, premiums, and inflated drug pricing elsewhere. Also, why is there no mention of biosimilars? The system still incentivizes brand-name dependency. This is optics, not reform.

eric fert

Oh, here we go again. The media’s acting like this is some historic breakthrough. Newsflash: the $2,000 cap has been in the law since 2022 - it just took three years to kick in. And let’s not forget, this only applies to stand-alone Part D plans. If you’re in a Medicare Advantage plan - which 70% of beneficiaries are - your out-of-pocket isn’t even tracked the same way. Plus, the ‘$0 premium’ plans for Extra Help? Those are often the ones with the worst networks. You get your drugs, sure - but only if you drive 40 miles to a pharmacy that accepts it. And don’t get me started on the late enrollment penalty - still a predatory trap for people who didn’t get the memo. This isn’t progress. It’s a PR stunt dressed up as policy.

Henry Jenkins

I’ve been helping my mom navigate this since 2020. The formulary changes every year - she’s had to switch meds twice because her plan dropped her arthritis drug. The new cap is huge, no doubt. But the real win? The Medicare Plan Finder tool finally works. Last year it crashed every time you entered more than three drugs. Now it gives you a full cost projection down to the dollar. I ran her list: $1,850 out-of-pocket last year. This year? $1,920. Wait - that’s higher. Turns out her new plan has a $50 premium and $0 deductible, but the copay for her blood thinner jumped from $12 to $45. So the cap doesn’t help if your drugs are priced like luxury goods. The system’s better, but it’s still a minefield. Always check the formulary. Always. Even if your plan says ‘$0 premium.’

Rakesh Kakkad

As an Indian immigrant who has seen both systems - this is still too complicated. Why can't the government just fix the drug prices? Why do we need 48 plans? Why do I need to know what a 'formulary' is just to get my pills? In India, we pay $2 for insulin. Here, it's $35 - and we still need to file forms, check tiers, call 1-800-MEDICARE, and pray. This feels like a bureaucracy trying to look compassionate. I respect the effort. But the system is still designed to confuse the elderly. Please make it simpler. Just make it simple.

TONY ADAMS

My aunt died last year because she skipped her heart meds to afford groceries. This $2,000 cap? It’s too late for her. But maybe it’ll save someone else. I don’t care about the politics. I just want people to live. If you’re reading this and you’re on Medicare - go to medicare.gov right now. Don’t wait. Don’t assume. Your life depends on it.

George Rahn

Another socialist handout disguised as healthcare reform. The Founding Fathers never envisioned a system where the government caps your drug costs because private enterprise failed. This isn’t freedom - it’s dependency. The real solution? Let the free market work. If drug companies can’t make a profit, they shouldn’t be in the business. We don’t need bureaucrats deciding who gets insulin and who doesn’t. We need competition. We need innovation. Not more entitlements. This is the slippery slope to rationing. And mark my words - next year, they’ll cap the cap even lower. And then? They’ll demand you pay more in taxes to fund it. This isn’t help. It’s control.

Ashley Karanja

It’s not just about the math - it’s about the peace of mind. I’ve sat with friends who cry when they open their prescription bottle and see the price. They don’t cry because they’re poor - they cry because they’re afraid. Afraid of tomorrow’s bill. Afraid of choosing between their medication and their grandkid’s birthday gift. The $2,000 cap doesn’t fix the pharmaceutical industry’s greed - but it stops the human toll. It turns a nightmare into a number you can budget for. That’s not policy. That’s dignity. And for people who’ve spent decades watching their savings vanish into pill bottles? That’s everything.

Karen Droege

Okay, real talk: I’m a pharmacist in Portland, and I’ve seen this play out for 20 years. The old donut hole? People would literally split pills. Cut their insulin in half. Take it every other day. I’ve held people while they sobbed because they couldn’t afford their chemo. This change? It’s not perfect - but it’s the first time in my career that I can tell a patient, ‘You won’t go broke this year.’ That’s not a policy win - that’s a moral win. And yes, formularies still suck. And yes, premiums still exist. But if you’re spending $2,000 on meds in a year, you’re not ‘rich.’ You’re surviving. And now? You’re surviving with dignity. If you’re on Medicare - go to medicare.gov. Do it today. Don’t wait for ‘next year.’ Your future self will thank you.

Ashley Porter

Wait - so the $2,000 cap includes manufacturer discounts? That’s wild. So if a drug’s list price is $1,000 and the manufacturer gives a 10% discount, that $100 counts toward your cap? That’s a loophole. Pharma’s basically paying part of the cap for them. Smart. But also… kinda shady? I mean, it’s still better than before, but the math feels engineered.

SWAPNIL SIDAM

My dad took 12 pills a day. Last year he spent $7,800. This year? $1,950. He cried when he saw the bill. Not from sadness - from relief. He said, ‘I can buy socks again.’ That’s all we’re asking for. Not luxury. Just socks. And now he can. Thank you.